Social Security Tax 2025 Max

BlogSocial Security Tax 2025 Max. Earnings above that threshold aren't taxed for social security. We raise this amount yearly to keep pace with increases in average wages.

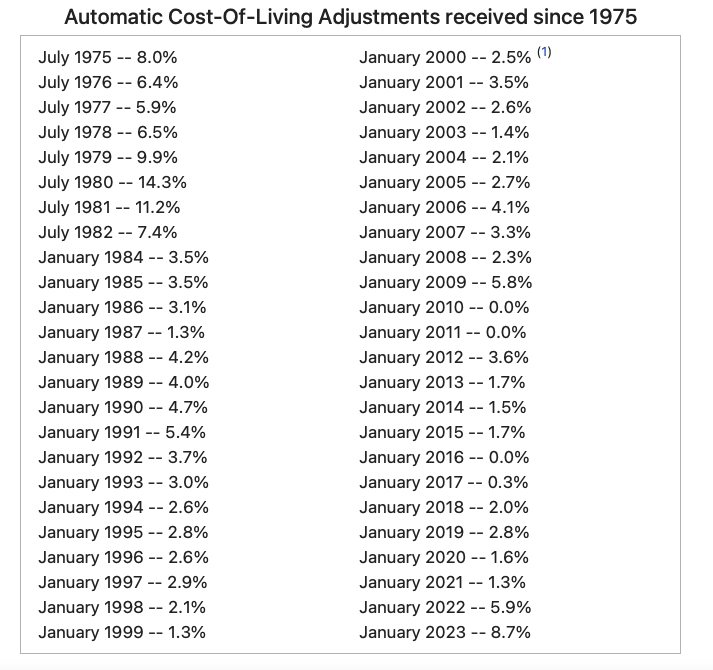

The 2025 cola adjustment raises the total average benefit to $1,907 per month for individual retirees and to $3,033 per. 2025 social security tax limit max.

Social Security Employee Tax 2025 Berna Cecilia, We raise this amount yearly to keep pace with. To elaborate, the tax rate is generally 6.2%, meaning a worker with income.

What Is The Ss Limit For 2025 Donny Genevra, Your employer also pays 6.2% on any taxable wages. The maximum social security benefit in 2025 is $3,822 per month at full retirement age.

Max Ss Benefit 2025 Kyle Shandy, The maximum social security employer contribution will. As kiplinger reported, the social security tax wage base jumped 5.2% from 2025 to 2025.

What Is The Social Security Tax Rate For 2025 Madge Rosella, For 2025, the social security tax limit is $168,600. Workers pay social security tax up to a maximum income level, which was $160,200 in 2025.

Maximum Taxable Amount For Social Security Tax (FICA), To elaborate, the tax rate is generally 6.2%, meaning a worker with income. Individuals with multiple income sources.

Social Security Pay Chart 2025 Elise Corabella, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Social Security Tax Brackets 2025 Hedi Raeann, Your employer also pays 6.2% on any taxable wages. Workers earning less than this limit pay a 6.2% tax on.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, In 2025, the average monthly social security benefit is just $1,907 per month. This amount is also commonly referred to as the taxable maximum.

Limit For Maximum Social Security Tax 2025 Financial Samurai, In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600. This amount is known as the “maximum taxable earnings” and changes.

How To Calculate, Find Social Security Tax Withholding Social, The maximum social security benefit in 2025 is $3,822 per month at full retirement age. 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.

The 2025 cola adjustment raises the total average benefit to $1,907 per month for individual retirees and to $3,033 per.